European Car Market Sees Mixed Results in 2024

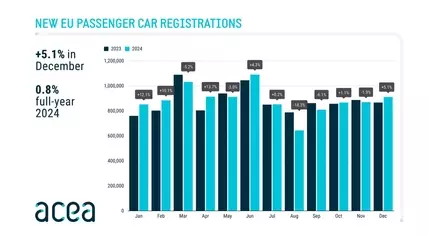

In 2024, the European automobile market experienced a mix of growth and decline. New car registrations increased marginally by 0.8%, reaching approximately 10.6 million units. Spain stood out with a robust 7.1% increase, while other major markets like France, Germany, and Italy saw declines. December brought some positive trends, with overall EU car registrations rising by 5.1%. However, battery-electric vehicle registrations faced challenges, dropping by 10.2% in December. The shift towards hybrid-electric vehicles continued, capturing a significant market share. This report delves into the dynamics of these changes and their implications for the automotive industry.

The European car market's performance in 2024 was marked by varied outcomes across different countries. In Spain, the resilience was evident with a solid 7.1% growth rate, driven by strong consumer demand and favorable economic conditions. Conversely, France, Germany, and Italy experienced declines of 3.2%, 1%, and 0.5%, respectively. These fluctuations highlight the differing economic landscapes within the EU. December saw a notable uptick in new car registrations, increasing by 5.1% compared to the previous year. Spain led this surge with an impressive 28.8% rise, followed by a modest 1.5% increase in France. However, Germany and Italy witnessed declines of 7.1% and 4.9%, respectively, reflecting ongoing challenges in these markets.

The power source preferences among consumers also shifted significantly in 2024. Battery-electric vehicles (BEVs), once a promising segment, saw a decline in registrations by 10.2% in December, totaling 144,367 units. This downturn was primarily attributed to substantial decreases in Germany (-38.6%) and France (-20.7%). Despite this setback, BEVs maintained a market share of 13.6% for the year. On the other hand, plug-in hybrid electric vehicles (PHEVs) saw a 4.9% increase in registrations last month, driven by significant gains in France (44.9%) and Germany (6.8%). PHEVs accounted for 8.3% of the market in December, aligning with the previous year's figures. Hybrid-electric vehicles (HEVs) gained momentum, with a 33.1% increase in December, capturing a market share of 33.6%. HEVs surpassed petrol cars for the fourth consecutive month, signaling a growing preference for more sustainable options.

Petrol and diesel vehicles continued to face challenges. Petrol car registrations dropped by 1.8% in December, with declines observed in all major markets except Spain, which saw a 16% increase. France experienced the steepest drop, with registrations plummeting by 23%, followed by Italy (-11.4%) and Germany (-7.4%). Diesel cars also saw a decline of 15%, resulting in a 9.8% market share last December. Overall, most EU markets recorded double-digit declines, emphasizing the ongoing transition away from traditional fuel types.

The year 2024 showcased the complexities and shifts within the European car market. While Spain demonstrated resilience, other key markets faced setbacks. The decline in battery-electric vehicle registrations highlighted challenges in certain regions, yet the rise of hybrid-electric vehicles indicated a growing trend towards more sustainable transportation options. The automotive industry must adapt to these changing consumer preferences and economic conditions to navigate the evolving landscape successfully.